Perspectives

In an age where every second counts, the resurgence of in-store shopping presents a paradox: shoppers are returning to physical retail, but they have less time and patience than ever. Should brands try to save shoppers time or spend more time with them to build deeper, more meaningful connections? The smartest brands are doing both.

From retail apocalypse to revival: the resurgence of brick-and-mortar retail

Despite years of doomsaying around brick-and-mortar retail, physical stores are far from dead. In fact, they are resurging. According to Deloitte’s 2025 US Retail Industry Outlook, 80% of all shopping still happens in store and the shopping center vacancy rate is the lowest it’s been for 20 years at 5.4%.

There’s a reason for that: shopping IRL is tactile, human, and emotional. It’s social, experiential and even escapist. And on the other side of the coin, a recent WARC/Criteo study showed how online shopping has become a ‘joyless scroll’ with 79% of consumers saying it’s lonely and 78% feeling overwhelmed by the abundance of choices online.

A tension retailers must resolve: save time or spend time with shoppers?

For years, brands’ strategies for their physical store and brand experience have been all about drawing people in, getting them to engage with the brand, and finding ways to make them stay longer in the quest to build deeper, more meaningful relationships.

Today, the physical store is being pulled in two directions: consumers want that engagement and immersion, but they also want speed and convenience. This is the central design challenge for modern retail: How can you build brand love while respecting your customers’ limited time?

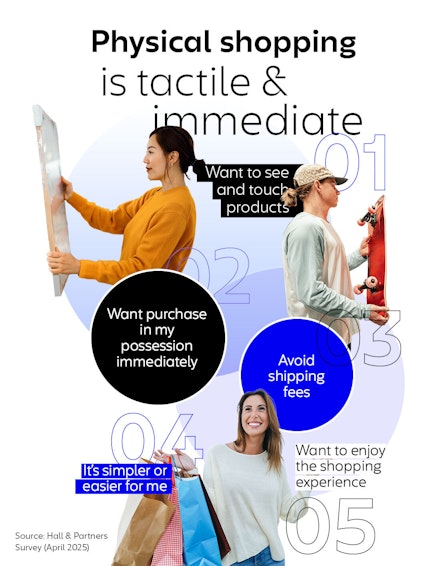

According to a Hall & Partners survey, 62% of shoppers choose physical retail because they want to touch and feel the products and 41% crave the instant gratification of walking out with their purchase. At the same time, 23% want in-store shopping to be simpler and 16% actively want to save time. Some shoppers want to spend time exploring, others want to get in and out – and many want both: a frictionless buying experience that’s enjoyable, inspirational and feels new.

The duality is particularly pronounced among Gen Z. Despite being digital natives, they still value the in-store experience and exploration. Yet, their expectations for speed and convenience may be higher: 60% of Gen Z say they will abandon a purchase if the checkout line is too long, and more than 25% will leave if their preferred payment method isn’t available (Ayden, 2024).

An immersive in-store brand experience strengthens customer relationships

Some brands are already solving this paradox by designing for both speed and immersion.

- Apple has mastered the hybrid model. Shoppers can move seamlessly between digital and in-store experiences. Products are displayed in a hands-on format, while the Genius Bar and Today at Apple sessions create immersive experiences. Check-out is frictionless, often handled by roaming associates with mobile devices.

- IKEA has evolved from its warehouse origins. It’s smaller ‘Plan & Order Point’ formats allow customers to meet with design experts for personalized support, while the app offers 3D visualization tools, personalized recommendations and streamlined checkout with scheduled order pick-ups.

- Canada Goose has created Cold Rooms in select stores, letting customers test jackets in freezing conditions before buying, while also offering a fast-track experience with knowledgeable brand ambassadors and integrated checkout.

These brands don’t make shoppers choose between efficiency and experience; they deliver both.

The new benchmark: delivering efficiency without compromising brand experience

To thrive in this new era of hybrid and heightened expectations, retailers must design experiences for both the mission-driven shopper (get in, get out) and the exploration-driven shopper (browse, linger, discover).

Brands that are strategizing about both saving their customers time and spending time with them in the right ways will win. The path to do this will look different for every brand, but the following thought-starters and considerations, based on the ‘See, Feel, Think, Do’ model, developed by Hall & Partners and rooted in behavioral and social sciences will help to shape physical brand strategies:

SEE: Create a visible brand experience

- Differentiate on design: Ensure the in-store environment visually reflects the brand’s unique personality through visuals, tone and features in memorable ways.

- Signal efficiency early: Show customers their time is valued with smart layouts, clear signage and time-saving features.

FEEL: Build emotional relevance

- Prioritize human moments: Use well-trained staff to provide emotional reassurance, not pressure.

- Highlight sensory experiences: Help customers touch, test and try things they can’t online.

- Reinforce social proof: Bring popular reviews and peer endorsements into the store environment to help with decision-making in creative ways.

THINK: Offer compelling reasons to visit IRL

- Create exclusivity: Feature in-store only items, drops or services.

- Personalize intelligently: Use data to tailor suggestions, layouts and experiences to individual preferences.

- Show cost and time savings: Highlight value vs. online (e.g. no shipping fees, instant pick-up).

DO: Make it easy to get in and out

- Streamline checkout: Use mobile POS, self-check-out or contactless payment options.

- Guide the journey: Use smart signage, in-store navigation apps and proactive staff to make it straightforward to navigate.

- Enable channel fluidity: Build strategies that allow easy transitions between in-store and online browsing, buying and returns.

- Celebrate the win: Make leaving with a purchase in-hand feel like a reward, not just a transaction.

The stakes are rising

Retailers who aren’t thinking about how to solve this tension between ease and excitement risk losing both mission-driven shoppers and those that are exploration-driven. But brands that build dual-speed experiences into their strategies will succeed on both fronts: delivering loyalty-building engagement and conversion-driving convenience. There’s no one-size-fits-all solution though.

At Hall & Partners, we work with brands to help them understand and segment their shoppers, be top-of-mind for relevant shopping occasions and build more rewarding experiences for shoppers.

The future of physical retail isn’t slower or faster. It’s smarter.

SOURCES:

- Deloitte. (2025). U.S. Retail Industry Outlook.

- CBRE. (2024). Reports of Street Retail’s Demise Are Greatly Exaggerated.

- WARC & Criteo. (2024). Reframing Online Shopping.

- Hall & Partners. (2024). In-Store Shopping Survey.

- Adyen. (2024). Retail Report: Gen Z Expectations.

- IKEA. (2024). Store Concept and App Update.

- Canada Goose. (2024). Cold Room Experience Overview.

Talk to our team of experts

Learn how we can deliver actionable insights and creativity to drive brand growth.