LOOKING BEYOND OIL

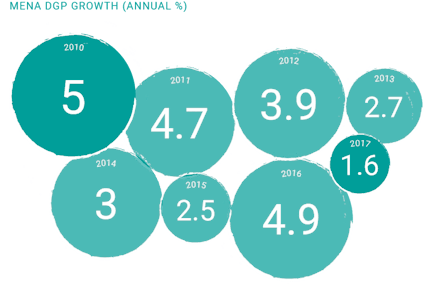

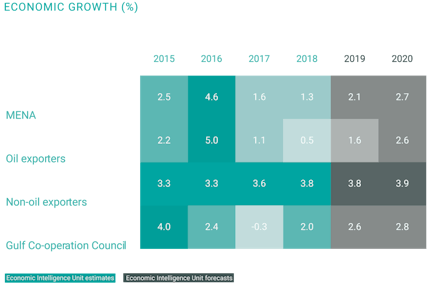

Oil has already been very closely tied to the MENA economy, particularly Gulf countries like Saudi Arabia. Egypt has recently become a gas producer. As reserves diminish and prices fluctuate, this reliance on oil has become a necessity. In its World Economic Outlook for 2019, the IMF forecast that growth in the MENA, Afghanistan and Pakistan regions will decline to 1.5%. The slowdown is a result of multiple factors, including the GDP growth of oil in Saudi Arabia.

Decreasing oil prices and regional political instability over the last decade have galvanised local governments – particularly in the Gulf – to come up with long-term sustainable solutions to drive growth. In the UAE and Saudi Arabia, this took the form of bold national visions that ensure they are ready for the future, including investments in industries outside of oil and gas. When Uber bought Careem, Dubai’s ride-hailing platform, for $3.1bn – after Amazon acquired Souq.com for $580m – the attention turned to the region’s technology sector and its emerging new economic reality.

SO WHAT?

The political, social and economic differences between each country in the MENA region have created multiple opportunities and challenges for companies operating there. In the Gulf, in particular, economics are opening up to foreign investment, and global brands are already benefitting from these new markets.

AN OPENING UP OF THE REGION

The desire for the region to integrate into the global economy has steadily increased over recent years with many countries, particularly in the Gulf, investing in tourism. With decreasing oil revenues, the policies of insularity and protectionism are looking less prudent. The gap between MENA and the rest of the world is closing, thanks to the reforms and policies that some Arab countries are adopting to increase their competitiveness and attractiveness.

The MENA region saw an 8% decline in visits during the Arab uprisings of 2011, according to the UN World Tourism Organization. Fast-forward to 2011, UNWTO reported a 10% jump in North Africa tourist arrivals, with a similar rise in the Middle East. This is compared to about a 3% increase in travel to the Americas (North, Central and South). Many countries across MENA seem to be making a big comeback – and for more than just stabilising political climates.

SO WHAT?

With its large population of under 25s, the Middle East actively seeks to build employment opportunities across various sectors, as well as better entertainment options. Large-scale events such as Expo 2020 and the 2022 World Cup have gained traction and opened up markets in the region for potential growth. Saudi Arabia is the latest country to invest in tourism through its Vision 2030 and National Transformation Plan. With the Red Sea project – set to be ready by 2022 – the Kingdom is painting itself at a luxury tourist destination. It also recently began hosting concerts with international artists, such as Enrique Inglesias and Mariah Carey, and allowed cinemas to be opened for the first time in over 30 years.

EMBRACING A HEALTHIER LIFESTYLE

High levels of obesity and diabetes have bought about a growing interest in pursuing healthier lifestyles. This is driving the public health agenda, particularly through sport. MENA is witnessing a rapidly growing health and fitness culture which is being influenced both from the top by governments and the bottom by individuals. The sense of national pride engendered by the participation of athletes and teams in international competitions also plays a part. There are more gyms, greater mass participation and attendance at events, along with an overall increase in awareness about health and wellness. Veganism and yoga are also on the rise across the region.

Abu Dhabi made history in March 2019 by hosting the region’s first Special Olympic World Games. There have been breakthroughs in women’s sport in Arab countries, from Saudi women competing at the Olympics to Jordan hosting the FIFA Under-17 Women’s World Cup. Demand for gym memberships and personal fitness training sessions is also increasing. In fact, as part of its Vision 2030, Saudi Arabia aims to increase the number of individuals exercising at least once a week from 13% to 40%.

SO WHAT?

The increased consciousness about health and fitness has resulted in a more informed population. People in MENA are starting to hold their governments and corporations, as well as themselves, more accountable for public health. Several governments in the region are reacting to this trend: for example, since 2017 Dubai has backed an annual ‘fitness month’, challenging corporations to take part as well.

THE CHANGING MEDIA LANDSCAPE

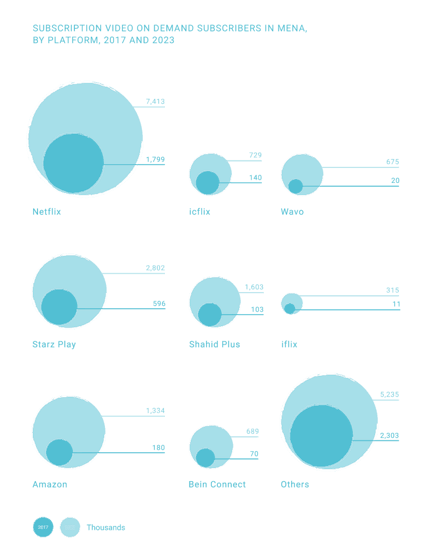

Linear, real-time TV is increasingly becoming a thing of the past, mostly confined to major sporting events. Audiences around the world now look for convenience, and video on demand (VOD) has become the most popular way to consume content. The entertainment world is constantly evolving. In 2019, Disney has solidified its position as a force to be reckoned with, both through acquisition and by launching its own streaming service to compete with Netflix.

When it comes to the MENA region, online international broadcasters are rushing to connect with local audiences. Content creators are heavily producing Arabic content, from digital platforms like Netflix and StarzPlay to TV channels such as OSN and Disney. Some companies, including STC (Saudi Telecom), have also made significant investments with local content creators. MBC Group’s Shahid, originally a catch-up TV platform, is transforming into an on-demand platform, not unlike Netflix. The on-demand model, made possible by digital technologies, is equally transforming publishing and, to a degree, radio. Although paywalls are still a rarity in the Middle East, the subscription model is making inroads, complementing local media owners’ advertising revenues that are under pressure from the global giants.

SO WHAT?

VOD is only set to increase within the region, with estimates suggesting subscriptions could double by 2024. In order to attract Arab audiences and compete with local players such as Icflix and Shahid, global giants Netflix and Amazon have joined the fray, investing heavily in local productions, as they have done elsewhere. Netflix and Amazon use data to fine-tune their content selection, becoming more relevant with local audiences and capturing a greater share of their time with media and entertainment expenditure.

SHIFTING FEET

Consumers are spoilt for choice with the multitude of digital retailers and ecommerce vendors that have entered the MENA market. The situation was very different a few years ago though, and retailers have adapted to the ever-changing needs of their digitally savvy audience.

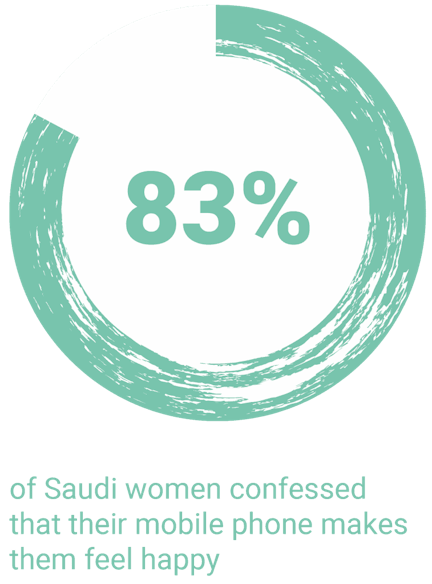

Brands aim to provide omnichannel experiences, so consumers feel connected at every stage of the purchase funnel: information gathering, comparing alternatives, speed of purchase, role of mobiles and user experience. Speed and good service are essential. Consumers still want the benefits of the physical shopping experience but with the convenience of online. Our research on luxury consumers in the UAE and Saudi Arabia also demonstrated a growing attachment to mobile, so getting these experiences right is very important.

SO WHAT?

Having a digital presence is no longer optional; it’s a pre-requisite if businesses are to survive. When we talk about mobile specifically, these devices have become an extension of individuals, and the imminent launch of 5G could fundamentally change the user experience. Brands must, therefore, be ready for and embrace these developments.

THE NEW LUXURY CONSUMER

The MENA region is big on luxury and exclusivity. Combined with a strong mobile affinity, this market is both lucrative and fast paced. Consumer journeys have been transformed in the digital age with multiple consumer touchpoints, so brand strategies have to keep up.

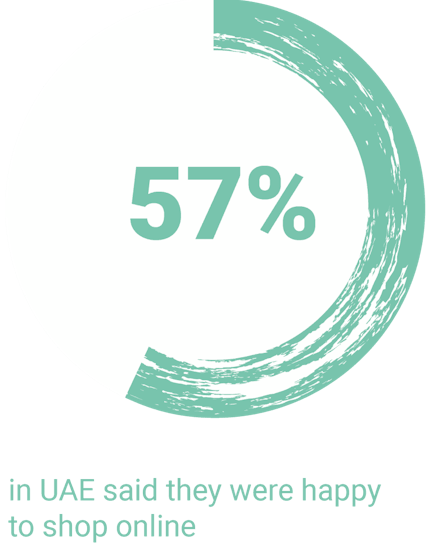

We conducted a study of the luxury sector in Saudi Arabia and the UAE to obtain an in-depth and up-to-date understanding of this audience. We discovered that mobile phones have played a significant role in moving high-profile shoppers from the awareness phase down to the conversion. In this category, as in many others, more and more consumers have started to give preference to online shopping.

SO WHAT?

Consumers in the MENA region are looking for holistic and joined-up omnichannel experiences, with personalised communication at every stage of the purchasing funnel. Now that brands have access to customer data, it’s extremely important they use this to unlock the opportunities it presents. Otherwise brands are in danger of being left behind.

SO, WHAT MATTERS TO BRANDS IN MENA

The MENA region isn’t homogenous. The disparities among countries highlight the importance for brands to view the region with an integral perspective, while keeping the local market in mind.

With the region’s economies opening up as part of the diversification process, the opportunities for foreign direct investment will continue to increase. Brands stand to benefit if they tap into the potential of new and emerging markets.

Companies must identify the changing attitudes and behaviours of their consumers in this region and use this insight to connect with them.

With the media landscape rapidly changing, the number of players in the market has increased. As a result, capturing the attention of regional consumers is going to continue to be a challenge.

The influence of rapid development and modernisation is creating opportunities in the healthcare, wellness and sports sectors as governments prioritise their healthcare agenda.

Marketers need to balance not only global positioning with local relevance, but also scale with exclusivity.

DOWNLOAD